Medicare Options

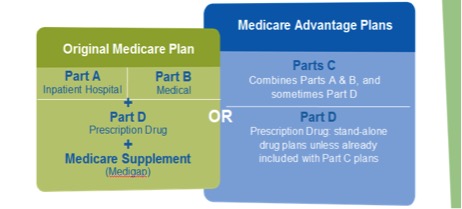

The chart below shows the two ways to have Medicare. If you choose Original Medicare, you sign up for Parts A and B and probably a Medicare supplement. Then you decide if you want prescription drug coverage under Part D. Although this shows drug coverage as optional it can be dangerous to go without drug coverage. I highly recommend that everyone choose to have some kind of prescription drug coverage starting from the outset of Medicare in order to avoid a future penalty when you do sign up for a prescription plan.

The second way to get Medicare is through a Medicare Advantage plan offered by a private insurance company. There are many companies in this area offering Medicare Advantage plans, so if you go this route, it will be important to shop for plans and find one that meets your needs. And again, drug coverage is shown as optional, but I would recommend that you choose a Medicare Advantage plan that offers prescription drug coverage.

If you get help through an insurance agent be sure to ask if the person is certified with Medicare Advantage plans as well as Medicare Supplement plans and that they represent several different companies. This way you are not being shown only one product when there may be others that better meet your needs.

CALL TODAY 330-774-1341

Questions about insurance, Medicare, or retirement planning? Reach out today and let us assist you with these important decisions. It is our pleasure to help and guide you towards your best options. We can meet at your home, one of our offices, or work over the phone.

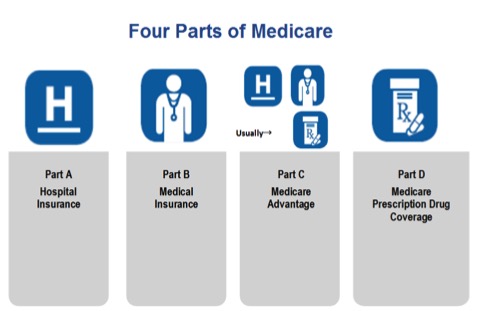

Part A covers an inpatient hospital stay after a deductible. It also covers skilled nursing care as well as some limited home health care and hospice care. In most cases there is no cost for Pat A of Medicare.

Part B covers a portion (usually 80% after an annual deductible) of medical services costs, such as doctor visits, procedures, diagnostic tests and other medical services not covered in Part A. There is a monthly premium for Part B. Most people pay $185 a month unless their income is low enough to qualify for help paying for it or their income is high enough that they pay extra for it. There is no maximum out of pocket limit for Parts A and B. The bills for Parts A and B are paid by Medicare.

Parts C and D involve private insurance. Part C is mostly referred to as Medicare Advantage here in northeast Ohio and is an alternative way to get Medicare benefits. It provides several different alternatives to traditional Medicare, each offered through many private insurance plans that Medicare regulates. This type of plan will include your services under Parts A and B, and usually prescription drug coverage as well. Instead of Medicare paying for your hospital and doctor bills, it pays the insurance company offering the Medicare Advantage plan a flat payment for each enrollee. Then the plan is responsible for managing and coordinating your care. There are many details to learn about these Medicare plans.

Part D is prescription drug coverage. It is offered by private insurers who contract with Medicare. Each prescription drug plan is slightly different, which is why you’ll want to shop carefully for your drug plan. Even if you don’t take any prescription drugs when you first go onto Medicare, you will still want to sign up for a Part D drug plan. Coverage under part D is very important because Medicare parts A & B do not cover prescriptions except those administered in the hospital. To go without drug coverage for a significant period of time would result in penalty charges when you eventually do need to enroll for Part D.

Medicare Supplement (Medigap)

See the table below for various benefits of the ten distinct Medicare supplement plans. One of these plans are usually chosen when a person elects to stay with Parts A & B of Medicare. These plans were standardized by Medicare so the benefits offered by each insurance company are the same. So you will want to ensure you are not overpaying for the same policy you can get elsewhere for less. Most importantly, you will want to check on the rate increase history over the last 8 – 10 years.

Medicare does not cover dental, vison, hearing, unless it’s related to disease or injury like cataracts or mouth cancer.

It also does not cover items considered to be “elective” like hair transplant and breast enhancement. Some companies are including things like acupuncture, and Viagra as they are recognizing other health needs.

Medicare Frequently Asked Questions

Why do I need something in addition to Medicare Parts A & B?

There is no maximum out of pocket limit with Medicare. So, a bad year of health expenses could cost tens of thousands of dollars in copays with Medicare alone.

What is the difference between a Medicare Supplement and a Medicare Advantage plan?

There are many. In a nutshell, supplements charge a monthly premium over $100 a month (and the premiums increase every year), do not include prescription drug coverage, but cover most Medicare copays and allow you to go to any doctor that accepts Medicare (which is almost all of them). Advantage plans are very low premium (many good ones are $0), have many extra benefits -dental, vision, hearing, and much more, include prescription coverage but do have copays for most medical treatments and have doctor networks (there are several comprehensive networks).

Do I need to worry about doctor networks?

Not with Supplement Plans. Good Advantage Plans have comprehensive doctor networks.

What about pre-existing conditions?

Depending on your individual situation – most people do not have any pre-existing condition limitations.

Should I get a PPO Advantage Plan?

It is usually not necessary to get a PPO because the good Advantage Plans have comprehensive doctor networks in their HMO’s.

Don’t Advantage Plans have high deductibles?

Most Advantage Plans have zero deductibles.

Where can I get help figuring this out?

Call Chris, he has been helping people for over 30 years and represents all the major Medicare companies in Ohio. He can explain things clearly and help you find the best plan for your needs.

Do I need to sign up for Medicare if I am still working or have insurance through a working spouse?

The short answer is no. But signing up for Medicare Part A is free and it does get you in the system. It’s also a very good idea to call and compare your insurance through work with a Medicare plan. Often the Medicare plan is better coverage for less money.